A financial obligation combination strategy is the loan consolidation of all unprotected financial debts into one regular monthly repayment to a third-party agency, usually not-for-profit. Financial debt consolidation can eliminate financial obligation while improving your credit score with prompt regular monthly repayments at minimized fixed rates of interest. Find out the internal technicians of a free counseling session as well as what debt assessment requires with a not-for-profit. The settlements are sent monthly as they are received under changed terms bargained by your not-for-profit credit history therapy company. The customized terms consist of:

- Stopping collection telephone calls

- Quitting recently, unpaid, as well as over-the-limit fees

- One lower regular monthly settlement that obtains you out of financial debt in 5 years or much less

- Decrease of rates of interest to one single figure fixed price

- Adjustment of the due date based on your other expenses as well as pay schedule

- Bringing past due accounts existing without paying anything added

- Keeping accounts reporting positively to help boost your credit history

TIP: If you’re not behind and also exist a not-for-profit debt combination plan can keep your accounts present so it does not hurt your debt rating.

TIP: If you’re behind and obtaining several costs a nonprofit financial obligation loan consolidation plan quits those quickly after registration and brings the accounts to a present standing so they begin building back your credit report.

TIP: Most customers are paying 2-3 different interest rates between purchases, cash advances, as well as balance transfers. A loan consolidation strategy creates ONE low fixed APR, generally in the solitary figures between 0-9 percent.

A debt combination plan will certainly begin with a counseling session offered totally free by a qualified credit rating therapist. These monetary therapy sessions usually begin with a budget plan analysis, covering your financial obligation to income ratio on a month-to-month basis. This allows both celebrations to recognize where the consumer currently is with their funds and also check out available alternatives from there.

TIP: Therapists usually find ways for consumers to save cash monthly in their normal costs outside of the loan consolidation. Ask a qualified counselor concerning insurance plans and also energy packages.

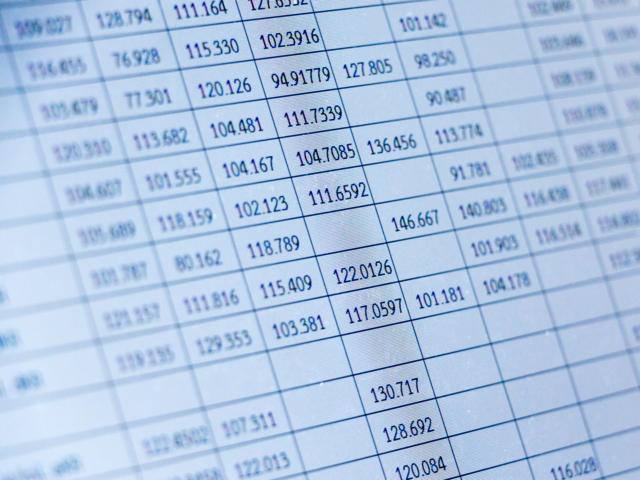

For the financial debt combination quote, a licensed counselor will certainly desire an accounting of the unprotected debts seeming consolidated. To supply an exact savings and payment price estimate a therapist will require each lender’s name, balance, as well as existing rates of interest for the consolidation of the accounts. This enables the counselor to develop a cost-effective month-to-month repayment within the consumer’s spending plan that will deal with each lender’s guidelines for minimal regular monthly repayments to be financial obligation complimentary in 5 years or much less.

TIP: You do not have to settle all your bank cards as well as unsafe debts. You can leave some out as required.

TIP: There is no minimum financial debt amount with nonprofits. If they can assist you to save cash they will, no matter just how much debt you have. $10k minimum financial obligation requirements are primarily for commercial agencies posing as nonprofits as well as must be reported to the FTC ASAP.

TIP: Not-for-profit loan consolidation plans are developed to obtain you out of debt in 5 years. A debt combination organization must not charge you anything added or allot a service charge for paying off the financial obligation earlier than the 5 years intended.

Once a month-to-month payment quantity is established that is inexpensive for the customer the therapist will after that ask the customer to pick a repayment date that works finest for them around their pay schedule as well as regular monthly expenses. This brand-new due date is then negotiated by the org on your behalf to ensure payments are taken into consideration on schedule as well as continue to help improve credit reports.

TIP: 35% of your credit score is comprised of a payment background. This is the largest factor in what influences your numeric credit history according to Start Smarter.

At this moment, you ought to have had a budget evaluation as well as a complimentary debt loan consolidation quote from your certified therapist. If the cost savings are there as well as the settlement is budget friendly it’s after that time to finalize documents and also obtain those financial debts consolidated!

Upon getting into a financial obligation loan consolidation program a qualified credit score therapist will ask you to make one last contact with your lenders to cancel any type of promotional strategies, insurance coverage, automatic repayments, and finally, the closing of the account. As soon as this has been achieved the financial debt consolidation org can begin managing your lenders and also collaborating with them straight.